If you’ve arrived at forgiveness and you make an additional payment once the helpful date of the forgiveness, overpayments will likely be 1st placed on any other fantastic federal scholar loans you might have or be refunded to you personally. When you don’t have any remaining loans, you may be sent a refund for these payments.

These alterations to PSLF tracking are huge advancements when compared Along with the earlier that would aid individuals really feel more confident regarding their timeline towards earning PSLF. In addition, it'll ideally assist borrowers capture discrepancies faster in lieu of later.

I had college student loans with FedLoan Servicing, and I consolidated with Nelnet. My issue is, will many of the payments I've compensated to FedLoan Service rely Regardless that I consolidated with Nelnet?

For those who’d like to repay your federal student loans under an cash flow-driven strategy, you need to complete an application. Utilize nowadays at StudentAid.gov/idr

Under PSLF’s needs, your 5 years of employment accustomed to get Teacher Loan Forgiveness wouldn't be credited to PSLF, as You can not at the same time qualify for each applications a result of the “double Rewards” provision.

The individual application process will allow just one of the joint consolidation loan co-borrowers to submit an application for separation of your joint financial debt, without having regard as to if or when the opposite co-borrower applies to different the credit card debt. In this situation, the borrower who relates to individual the joint debt should have their portion of the personal debt converted into a Direct Consolidation Loan.

Moreover, considering that only IDR payments on Direct loans rely in the direction of PSLF, borrowers who consolidate a combination of Immediate loans and FFEL loans will receive a new payment rely based upon the quantity of read more qualifying payments below a Immediate loan, divided by the volume of loans remaining consolidated.

By drop 2024, you’ll see updated PSLF credit rating for months of eligible deferment or forbearance. We strongly persuade you to attend till accounts are current with the payment depend adjustment just before having added PSLF steps.

This is sensible. I type of figured two payments wouldn’t going to rely, value asking even though. Thanks for the direction about needing to be in the job at the time I implement, I didn’t realize that. This task is comparatively stable And that i don’t see myself leaving ahead of the forgiveness period of time. Did you know everything with regards to the buyback method pointed out inside the new forbes report in regards to the new adjustments? I can’t appear to be to seek out Significantly and it doesn’t surface that they have got applied it nonetheless.

Commencing April 2022, borrowers whose programs were being rejected for PSLF up to now can request a reconsideration on line at studentaid.gov. Anyone who thinks their application must be reconsidered can post a request.

Below PSLF’s requirements, your 5 years of employment used to acquire Instructor Loan Forgiveness can not be credited to PSLF, as You can't at the same time qualify for each plans a result of the “double benefits” provision.

It’s not unheard of for borrowers to feel they’re creating progress in direction of loan forgiveness, only to find out some flaw that produced All those payments ineligible for PSLF. None of All those payments may be Licensed and count toward their forgiveness.

You may even be on an revenue-driven repayment (IDR) approach that caps month to month expenditures in a set percentage of one's money. Any forgiveness you receive received’t be taxed.

Rates are subject matter to change unexpectedly. Not all applicants will qualify for the bottom rate. Lowest premiums are reserved for quite possibly the most creditworthy applicants and can depend on credit rating score, loan expression, as well as other variables.

Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Earvin Johnson III Then & Now!

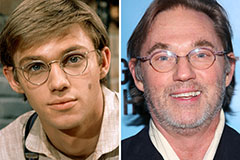

Earvin Johnson III Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!